Gratuity vs Tip | Key Differences in 2026

Most employees in the UAE, USA, and Canada get confused about the gratuity vs tip concept, and some employees merge them. Typically, both gratuity and tip payments are made to employees, but they have different terms, legal implications, procedures, and financial impacts.

The meaning of gratuity and tip is used interchangeably. However, in this article, we will explore the gratuity and tip differences and why understanding these terms is important in 2026. Let’s deep dive!

What is Gratuity?

Gratuity is a legal lump-sum amount of money that an employer or company gives to their employees as a reward or appreciation for their long-term service years, they have worked for them. Gratuity is typically given when an employee retires, resigns, or is laid off.

In most countries, including the UAE, the gratuity is governed by the labour law and must be provided to employees as an end-of-service benefit. However, it’s important to note that gratuity is not always the same as a tip, and they serve different purposes.

Key Points about Gratuity

To remind you what is gratuity in salary, you must remember the following points about gratuity;

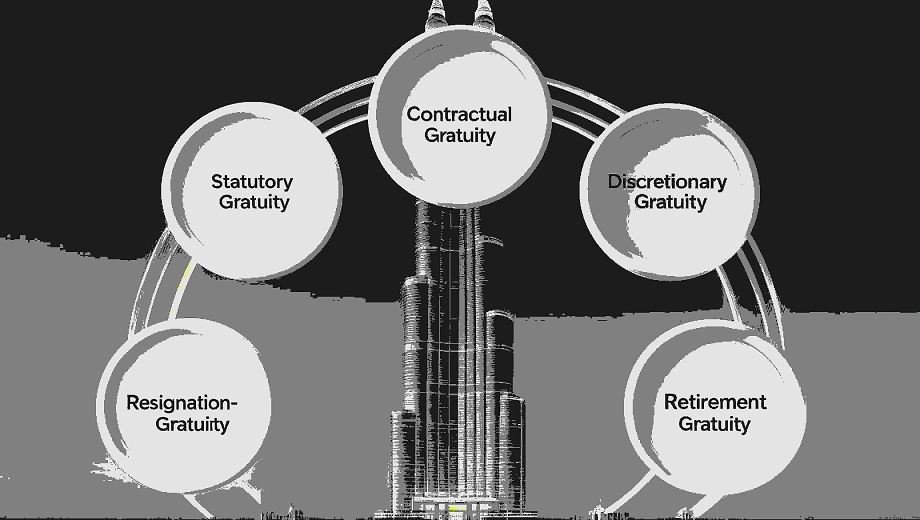

5 Types of Gratuity

Gratuity amount can be paid in different types, and understanding each type helps you get the correct amount of money. These types vary by company, location, country, and type of contract, and here are the top 5 types of gratuity that are commonly used;

Statutory Gratuity

Statutory gratuity is the mandatory payment governed by MOHRE and UAE labour law. It’s typically calculated based on the number of years, type of employment contract, and last basis salary. It must be paid when the employee leaves after completing a minimum service requirement (one year).

Contractual Gratuity

Contractual gratuity is not governed by law. The company pays it based on its policies and rules. Most employees consider the contractual gratuity a better option than statutory gratuity, as it can be negotiated between the employer and employee before the start of employment.

Discretionary Gratuity

Discretionary gratuity is not required by the labour law; however, it’s the sole discretion of the company to give a gratuity amount to the employee as a gift or reward even employee doesn’t complete one year of service. This acts as a bonus for an employee’s exceptional performance.

Resignation Based Gratuity

If an employee resigns from the job after completing one year of service, they will be eligible for gratuity payment from the employer under Article 51. The gratuity amount will depend on how long the employee has served and their basic salary on leaving the job.

Retirement Gratuity

Employees who retire after working for a specific number of years with the same company get the retirement gratuity. The amount of retirement gratuity is based on the employee’s salary at the time of retirement. Employees can receive extra rewards, such as retirement or pension, along with the retirement gratuity.

What is a Tip?

On the other hand, a tip is a voluntary amount of money given to workers by customers for their good service. Unlike gratuity, tipping is not mandated by law, and it’s typically provided in the service industry, such as in restaurants, hotels, or for personal services, for example pizza delivery boy. It’s not always guaranteed.

Key Points about Tip

Here are some notable points about Tip to better understand the gratuity vs tip concept;

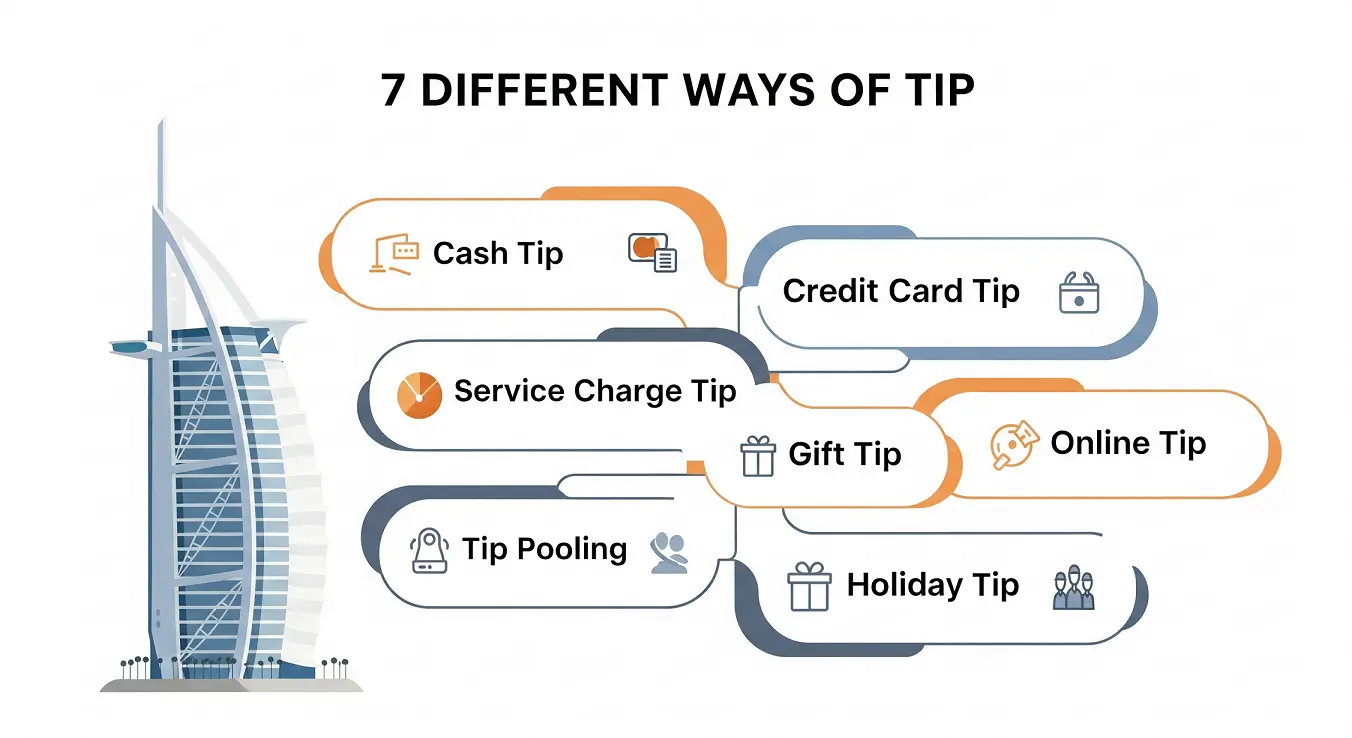

7 Different Ways of Tip

There are multiple ways to give a tip. Knowing each way of tipping can help you understand when and how to give to workers. Let’s explore the ways;

Cash Tip

A cash tip is the most traditional and flexible way of tipping. It’s given directly to the worker providing the service.

Tip through Credit Card

As the name suggests, the credit card tip is paid with the credit card. It is often added to the bill amount of restaurants and other service-based businesses around 10%-15%. It is a convenient and cashless transaction.

Online Tip

As online shopping and services are increasing, the popular way of online tipping is trending. It is most common in food delivery apps and e-commerce shops.

Service Charge Tip

In some cases, businesses add fixed service charges to the bill, which might not be the direct tip. However, service charges are shared among the staff. The fixed charges amount can be 10%-15% of the total bill and even 20% for excellent service.

Gift as a Tip

A gift tip is another way to appreciate workers for their good service. This may include small gifts such as perfume, a watch, or coupon codes.

Tip Pooling

Tip pooling is a term in which tips from all customers are collected and then distributed among all staff members. This practice is commonly used in restaurants.

Tip on Holiday

Holiday tipping is a tradition in many cultures where customers give extra tips to cleaners, guards, or waiters during the holiday season to show appreciation for the services provided throughout the year.

Key Difference between Gratuity and Tip

While both gratuity and tips are given as a form of appreciation, let’s find out how gratuity vs tip terms differ from each other;

Factor | Gratuity | Tip |

|---|---|---|

Who Pays | Company or Employer | Customer |

Mandatory by Law | Yes | No |

When Paid | After completing a certain criteria as per labour law | Immediately (after service) |

Calculation | Based on basic salary and service years | Depends on customer experience and satisfaction |

Legal Status | Protected | Non-Protected |

Industry Use | Over All | Hospitality, Shops, Food Chains |

In-Depth Analysis of Gratuity vs Tip

I have explained the gratuity vs tip concept with an in-depth comparison. The main difference is in legal implications and requirements.

Gratuity is mandatory in many countries given to employees for their service years who meet certain eligibility criteria, while a tip is an option not mandatory in any law, given for good service in businesses like restaurants, hotels, food, etc.

Importance of Gratuity in 2026

Gratuity remains an important part of the employment contracts in 2026 with the rise of employment opportunities in the UAE, India, and the United States. Labour law of local governments is enforcing strict policies on gratuity payments.

For employees working in the UAE, understanding gratuity calculations is crucial. They can check their estimated gratuity amount through the online gratuity calculator UAE to ensure that they receive what they are actually owed!

Tipping Trend in 2026

Tipping has evolved with technology, and in 2026, digital tipping is more common than ever. Even some restaurants introduced a service charge as a tip, and tip pooling is the most common term used nowadays service-based industry.

In some businesses, the trend of rewarding workers for their good service continues to grow.

Tipping Etiquette in the UAE and USA

Tipping etiquette varies widely from country to country. In the UAE, tipping is not required by any law, as it is the sole discretion of the customer to reward any worker for their good work. Tipping is a less common practice in the UAE as compared to the USA.

Surprisingly, the National Restaurant Association in the United States revealed that some business models have adopted a “no-tipping” model for a better user experience, but they are facing hurdles in staff retention and motivation.

It’s all because, in the USA, tipping is expected in many industries, and employees rely heavily on tips. If you don’t pay a tip in the UAE, it is not a big deal, but in the United States, even online servers demand for tip while shopping online (e-commerce, online services).

Misconceptions about Gratuity vs Tip

Here are some common misconceptions when people discuss about gratuity vs tip;

Misconception | Reality |

|---|---|

Gratuity is big tip | Gratuity is governed by law and it’s a legal benefit. |

Services charges are the tip | It depends on the business. Some businesses don’t distribute service charges among staff. |

If employee resigns, company will not pay gratuity. | If employee resigns after completing one year according to the local labour of the country, he will get the gratuity. |

Tip has fixed percentage. | No, tip is not fixed. It is up to the customer to pay the tip according to the service quality. |

Both gratuity and tip are paid by the customer. | Only tip is paid by the customer. |

Employees only get gratuity after working for at least 5 years. | Employees are eligible for gratuity even after completing one year. |

Final Words

This article provides the in-depth analysis of gratuity vs tip. Knowing the difference between gratuity and tip helps you avoid misconceptions and maintain a fair environment both in workplace and service based businesses.

In simple words, gratuity is a legal long-term end of service benefit taken care by the labour law and the tip is an optional term that totally depends on the customer satisfaction. Still have questions, no worries! Reach out to me and drop the comments below!