MOHRE Domestic Worker Gratuity Calculator

Calculation Results

Calculation Logic:

–

Many domestic workers, such as housemaids, chefs, nannies, or drivers, are also eligible for their end-of-service benefits in the UAE. But unfortunately, some of them are misguided by their owners, and even some owners are unaware of this benefit. This confusion is common because the law for domestic workers in the UAE is slightly different from the standard UAE labour law.

In this guide, I will explain the methods for housemaid gratuity in UAE according to the Federal Decree-Law No. 9 of 2022. I will show you how to find out what you are owed while working as a household employee. Whether you use a specific MOHRE domestic worker gratuity calculator or a general gratuity calculator UAE, this guide will give you the clear answers you deserve.

Who are Domestic Workers in UAE?

In the UAE, domestic workers are people who work for a household and provide services to them. The legal term “domestic worker” covers more than 19 jobs, such as housemaids, waiters, nannies, cooks, private drivers, and gardeners. The domestic workers include, but are not limited to;

What is Domestic Worker Gratuity in UAE?

Domestic worker gratuity is a mandatory end-of-service financial benefit given to household employees after completion of one year of service. You can think of it as a “leaving bonus” to thank them for their dedicated services under your ownership.

As per the UAE Federal Decree-Law No. 9 of 2022, all domestic workers who have completed at least one year of service are entitled to a gratuity payment.

Gratuity Calculation for Domestic Workers

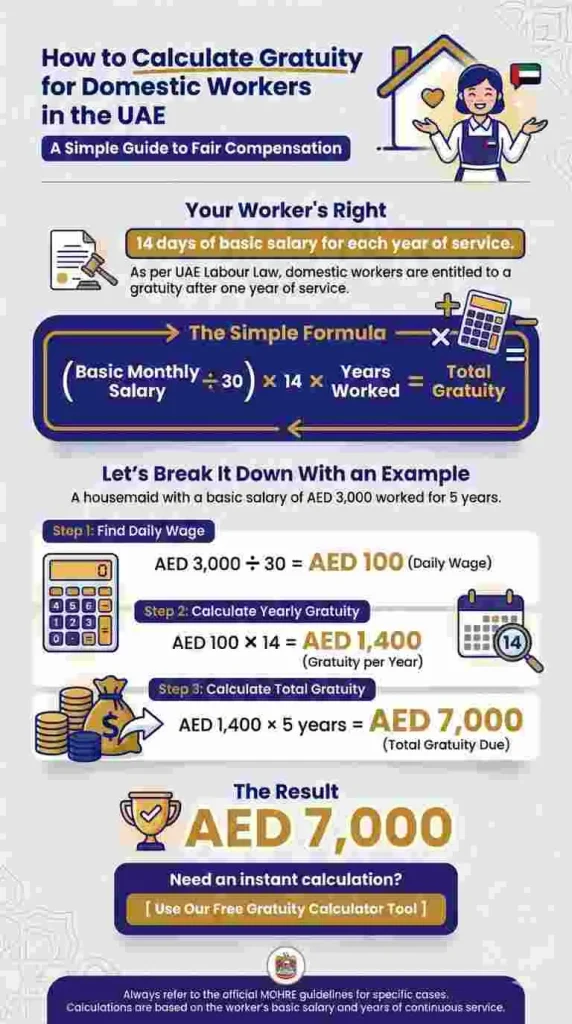

It is important to know that the calculation for domestic workers is different from other private sector employees. For private sector employees, the gratuity is calculated on the basic salary of 21 days, whereas domestic workers are entitled to 14 days of basic wage for each year of service.

Let’s simplify the gratuity calculation methods for each category;

How to Calculate Gratuity for Domestic Workers in UAE?

Calculating your gratuity is no longer complicated. As per the latest UAE labour law, domestic workers are entitled to 14 days of basic salary for one year of service and so on. Our gratuity calculator tool for domestic workers provides accurate gratuity calculations aligned with the legal reasons for leaving the job.

Step by Step Guide

Here is the simple formula of MOHRE domestic worker gratuity calculator;

(Monthly Basic Wage ÷ 30) × 14 × Number of Years Served = Total Gratuity

Let’s look at a practical example and solve it step by step. Imagine a housemaid has a basic salary of AED 3,000 and has worked for 5 years in a family.

So, after 5 years of service, she would receive AED 7,000 as her end-of-service gratuity. While this manual calculation is helpful, using our online domestic worker gratuity calculator is always faster and ensures you don’t make any math mistakes.

While the 14-day rule is the base for your gratuity, your final cheque might be higher (or lower) depending on a few other important factors. It’s rarely just a simple multiplication.

Here is which factors may add to your final settlement amount:

Unused Annual Leave: Every domestic worker gets 30 days of paid leave per year. If any domestic worker didn’t avail these leaves, their employer must pay them cash for those days in their final settlement.

Overtime and Rest Days: Did you work on your weekly off day? If you worked on your designated rest day and weren’t given another day off (as compensatory leave) or paid for it, this amount must be added to your final settlement calculations.

On-Duty Injuries: If you suffered an injury at work that resulted in a disability, you might be entitled to special compensation under the law.

Important Note: Always check if you have any outstanding debts or loans taken from your employer, as these will be deducted from this final amount.

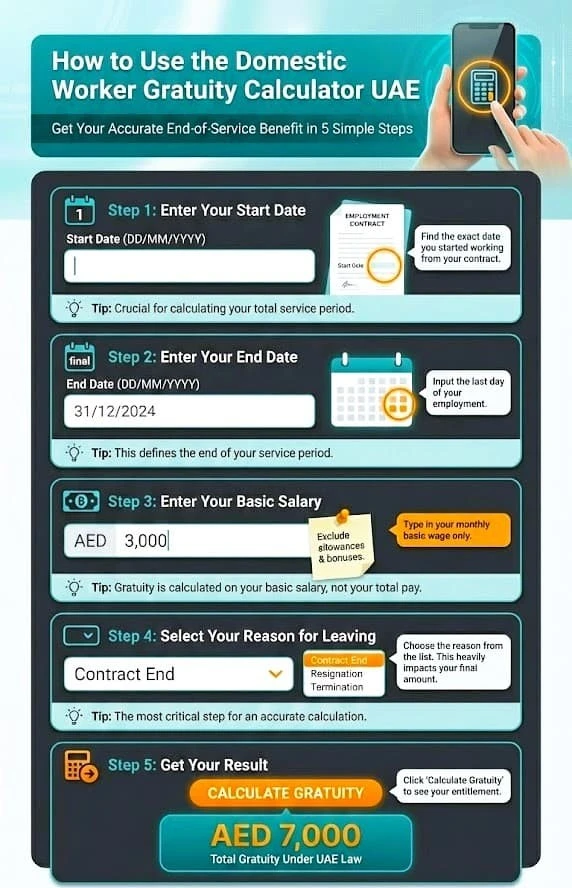

5 Steps to Use Domestic Worker Gratuity Calculator?

Using our online gratuity calculator is the easiest way to get an accurate figure without dealing with complex math. It takes less than a minute and gives you peace of mind.

Here is a simple step-by-step guide to using it effectively:

Our MOHRE domestic worker gratuity calculator ensures that both you and your employer are on the same page, avoiding any misunderstandings about the gratuity calculations.

Legal Aspects of Domestic Worker Gratuity Calculation

The good news is that the UAE is committed to protecting the rights of domestic workers as per the Federal Decree-Law No. 9 of 2022, Article 19, which replaces the old law of 2017. It shows how much the UAE government is seriously treating domestic workers fairly by making sure their benefits are protected and monitored by federal law instead of just verbal agreements.

Article 19 of this law plays a vital role in this development. It says that households have to pay all of their end-of-service money within 10 days of the contract ending for domestic workers. The Ministry of Human Resources and Emiratisation (MOHRE) keeps a close eye on this to make sure that no worker has to wait too long for their hard-earned money.

However, keep in mind that a domestic worker might not get all of their gratuity amount if they stop working without a valid reason or break the rules of the contract.

3 Major Reasons in Gratuity Calculations

How a domestic worker leaves their job is the single biggest factor in deciding how much gratuity they get. Here is how different situations impact the gratuity calculations of a domestic worker;

Full Gratuity: If a domestic worker completes their contract naturally or gets terminated by the employer with a reason of loss in the business naturally, they are entitled to their full gratuity.

Extra Compensation: In fact, the law adds a strong layer of protection here: if an employer terminates a worker without a valid reason (arbitrary termination), they must pay an extra compensation equal to one month’s total salary, along with gratuity. This ensures domestic workers are financially protected against unfair dismissal.

Loss of Gratuity: Similarly, the rules are strict if the worker decides to leave unprofessionally and unethically. If a domestic worker resigns without a valid legal reason, leaves without serving the required notice or without fulfilling the committmens mentioned in the contact, or simply stops working, they may lose their complete gratuity amount.

Real Life Examples of Gratuity Calculation for Domestic Workers

If you believe in practical examples, let’s look at two real-life examples to see how the reason for leaving can significantly increase the final gratuity amount of domestic workers in the UAE!

Scenario A: Normal Contract Completion

Situation: Owais Sheikh works as a personal driver. His basic salary is AED 1,500 per month. He has worked for a family for exactly 4 years, and his contract ends naturally on good terms.

Step by Step Calculation:

Step 1: Find the Daily Wage. First, we need to know how much Owais earns in a single day. We do this by dividing his monthly salary by 30.

- Calculation: 1,500 ÷ 30 = 50

- Daily Wage: AED 50

Step 2: Calculate Gratuity for One Year. According to the domestic worker law, Owais gets 14 days of pay for every year he works.

- Calculation: 50 (Daily Wage) × 14 (Days)

- Yearly Gratuity: AED 700

Final Gratuity Amount: In this smooth ending, Owais takes home AED 2,800 as his gratuity.

Scenario B: Unfair Dismissal

Situation: Now, let’s consider a different role. Owais Sheikh is working as a Family Driver. His basic salary is AED 2,500 per month. Unfortunately, he was fired by his employer without any valid legal reason (arbitrary termination) after working for 2 years.

Step-by-Step Calculation:

Step 1: Find the Daily Wage

- Calculation: 2,500 ÷ 30 = 83.33

- Daily Wage: AED 83.33

Step 2: Calculate basic gratuity. First, we calculate the normal gratuity for his 2 years of service.

- Yearly Gratuity: 83.33 × 14 = AED 1,166.62

- Total Gratuity for 2 Years: 1,166.62 × 2

- Basic Gratuity Amount: AED 2,333.24

Step 3: In this case, Owais is eligible for extra compensation because he was fired unfairly, and the UAE labour law protects him. He is entitled to an extra payment equal to one month’s salary.

- Compensation Amount: AED 2,500

Step 4: Calculate Total Payout. Finally, we add the gratuity and the compensation together.

- Calculation: 2,333.24 (Gratuity) + 2,500 (Compensation)

- Total: AED 4,833.24

Final Gratuity Amount: In this case, Owais receives AED 4,833.24 in his final settlement UAE.

5 Top Benefits for Domestic Workers in the UAE

Beyond gratuity, the UAE law guarantees several other rights to ensure domestic workers are treated fairly and with dignity. These are not just perks; they are legal requirements for every employer.

These basic benefits help domestic workers to stay motivated while managing our homes and families.

Final Words

Understanding your gratuity rights as a domestic worker is vital for your financial security. The new Federal Decree Law No. 9 of 2022 clarifies that you are entitled to 14 days of basic wage per year after one year of service.

Use our UAE domestic worker gratuity calculator to know exactly what you’re owed. While rules for a limited and unlimited contract in the UAE have changed for the general private sector but domestic workers have their own specific regulations. For official details, visit the UAE Government Portal. Being informed ensures a fair and smooth end to your employment.