Online Gratuity Calculator UAE 2026 (Updated with MOHRE)

Calculate your accurate end-of-service benefits in UAE!

Gratuity Calculation

| Year | Period From | Period To | Days | Gratuity (AED) |

|---|---|---|---|---|

| Total Gratuity Amount | 0.00 | |||

Gratuity, also known as مكافأة (gratuity meaning in Dubai & UAE Arabic), is a legal lump-sum payment from your employer that acts as an end-of-service benefit (EOSB) to say “thank you” for the time you have spent working for them as per the UAE labour law Article 51. Unfortunately, many people working in the UAE don’t actually know about these gratuity benefits. They might not understand how to calculate gratuity online as per the latest UAE labour law, how long you need to work to get it, or what other things can change the final amount.

This means employees could miss out on legal benefits they are owed! Manual gratuity calculations can also lead to discrepancies and errors. Don’t worry at all; you are at the right place. Our Gratuity Calculator UAE tool is here to help you. Just put in a few details, and it will quickly show you how much gratuity you should get. No more confusion, just clear information so you know what you’re owed.

What is Gratuity Calculator UAE Online?

The Gratuity Calculator UAE is a tool which is designed to facilitate you in calculating the accurate amount of gratuity payment, also known as end-of-service benefits, that you get in your full and final settlement after leaving the job as per Dubai and UAE labor law terms.

Whether you are going to resign or the company has terminated you after one year of your services, the good news is that you are eligible for the gratuity. To get more precise results of calculations from gratuity calculator Dubai, it’s important to consider all the factors like your basic salary, your contract type, e.g., limited or unlimited, and the number of service years you have spent in that company.

Entering the correct details in gratuity calculator UAE tool will provide you with the correct outcomes.

How does UAE Gratuity Calculator works?

It is more likely that manual financial calculations, especially gratuity amounts, can lead to mistakes and common errors. That’s the core reason why we have designed a free online gratuity calculator UAE for easy UAE gratuity calculation, which helps you figure out exactly how much you get your end of service benefit without any hurdles.

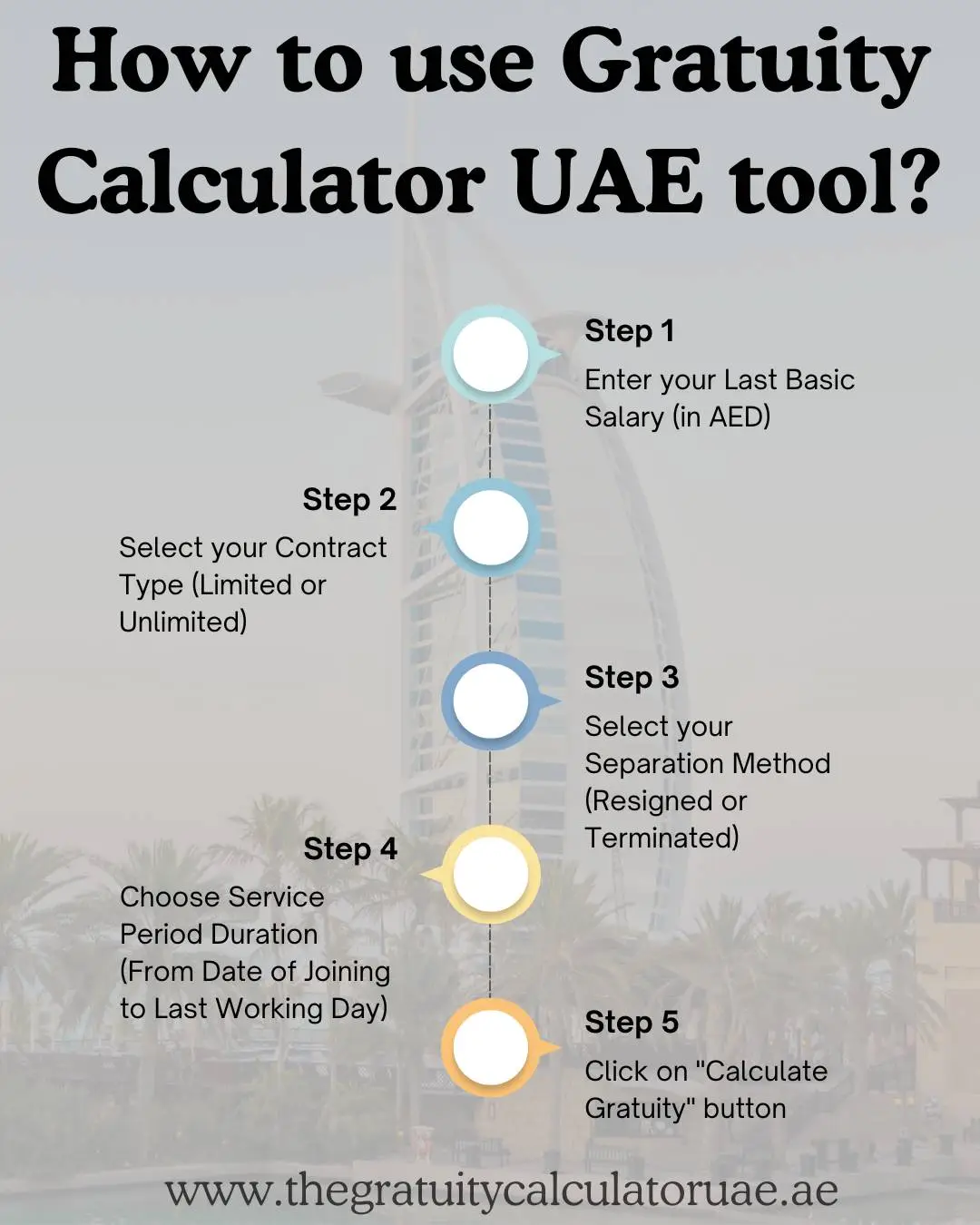

You just need to fill out the tool with a few details. Here is what you need to enter;

Boom, UAE gratuity calculations are done! Isn’t it simple with this new gratuity calculator UAE tool?

Benefits of Using a Gratuity Calculator MOHRE

Using the UAE gratuity calculator excel can fix a lot of things. The following are the benefits that you can get from this Jafza gratuity calculator;

How gratuity is calculated in the UAE?

UAE gratuity is calculated on the basis of 21 days’ wage for the first 1 to 5 years of service and 30 days for more than 5 years. The number of days without pay is not incorporated in the gratuity payment calculation, and employers may deduct that amount from the full and final settlement formula.

Here are some important points;

Gratuity Eligibility Days

You might think, who is eligible for gratuity? Well, this is an important question and every employee in the UAE must know the answer. Whether you work in Dubai, Abu Dhabi, or Sharjah, you will be eligible for UAE gratuity payment if you;

Key Steps for Calculating End-of-Service Benefits

As per Article 51 of the latest UAE Labour Law, it is compulsory for all employers to pay gratuity to expatriate private sector employees at the end of their service (starting from one year of service).

In order to calculate the gratuity using the end of service calculator Abu Dhabi, employees just need to enter a few things in the gratuity calculator UAE as I have already mentioned above in this article.

Complete Gratuity Minimum Years

The number of service years is the key factor when it comes to calculate gratuity UAE. For all private and public sectors, employees must complete one year of service to be eligible for gratuity payment. The gratuity calculator UAE tool is not for your if your service years are less than one year.

Understanding Basic Salary Calculation in UAE

Your basic salary in Dubai (excluding all other allowances under Article 134) is another important factor in getting an accurate gratuity calculation using the gratuity calculator UAE. You have to enter the exact amount of your basic salary in AED, otherwise, you will get a different result that may lead to misunderstanding and confusion.

For example, if your monthly gross salary is AED 15,000 (including transport allowance, house allowance, etc.) but your basic salary is AED 8,700 your gratuity will be calculated on the basis of AED 8,700 only. Entering the basic salary amount in the basic salary calculator UAE will provide you with accurate results. The Gratuity calculator for private employees also works on this method.

Identify Your Contract Type

The UAE gratuity calculation formula depends on your employment contract type. Select the contract type, whether you had a limited or unlimited contract with your employer in the UAE.

Specify the Reason for Leaving

The method of leaving the job directly affects the results of gratuity calculator UAE. Whether you were terminated or resigned, your gratuity amount will be different. So, select the correct reason to avoid mistakes.

Enter Your Service Duration

You have to enter the correct date of joining and the date of separation (last working day) in the gratuity calculator UAE to calculate the gratuity amount. These two entries decide your service year for the gratuity calculator formula.

Types of Employment Contracts in the UAE

It is important to know that the UAE labour law has significantly changed in the recent times. Previously, there were two types of employment contracts, limited and unlimited. However, under the new law, unlimited contracts have been completely suspended. Now, all employees in the private sector are on a single, standard contract that is the limited contract. The limited contract is also called fixed-term contract. Let’s explore each one.

Limited Contract

A limited contract is now the only standard job contract in the UAE. Think of it as a “fixed-term” agreement with a clear start and end date (e.g., two or three years). The main goal is to provide clarity and stability for both you and your employer from day one.

However, it can be extended with the mutual agreement between employer and employee, and the terms and salary will be revised in case of renewal of the contract.

Most importantly, the old rule about losing your gratuity if you leave early is no longer valid. Under the new law, if you have completed more than one year of service, you can resign before your contract ends and still receive your full gratuity payment. You just need to serve the notice period mentioned in your contract (usually 30-90 days).

Unlimited Contract

The unlimited contract, which had no specific end date, was completely removed from the labour law as of February 2023. While it is no longer issued, many people still remember the old rules, which can cause confusion during the employment.

Previously, the biggest issue with unlimited contracts was the gratuity calculation upon resignation. If you resigned under the old law system, your gratuity was heavily deducted as per following;

This confusing and unfair deduction system has been abolished, thanks to the new UAE labour law. The new all-limited contract system ensures every employee receives their full, entitled gratuity payment after one year of service.

Contract Renewals

As per UAE Labour Law Article 38, if a limited contract is renewed, the new contract is considered as part of the original one when calculating the gratuity and the gratuity calculation will be based on the total number of years an employee has worked for that employer. Confusing? No worries! In other words, the time from both contracts (limited or renewed) will be added together to calculate gratuity in UAE even though it’s a new contract.

Gratuity Calculation Formula as per UAE Labour Law

The general formula for UAE gratuity calculation is;

Gratuity = Basic Salary x Gratuity Days Per Year x No. of Service Years

Gratuity days per year depend on the type of service contract and the length of service years. However, the Gratuity calculation formula depends on the employment contract types. Let’s deep dive to break it down for each type.

For Limited Contracts

Service Years: 1 to 5

Gratuity = (Basic salary x 21 days x service years) / 30

Service Years: More Than 5 Years

Gratuity = (Basic salary x 30 days x service years) / 30

For Unlimited Contracts

End of service benefit rules will be different for both resignation and termination methods in unlimited contracts. Here are the gratuity calculation formulas for both categories;

In Case of Resignation

Service Year | Gratuity Calculation |

|---|---|

Resigning before 1 year | No gratuity |

Resigning after 1-3 years | 1/3 of 21 days’ basic salary for each year (Article 137) |

Resigning after 3-5 years | 2/3 of 21 days’ basic salary for each year (Article 137) |

Resigning after 5 years | 21 days of basic salary for the first 5 years, 30 days each year after |

In Case of Termination

Below is the calculation method if any employer terminates the employee (not under Article 120);

Service Year | Gratuity Calculation |

|---|---|

Terminated before 1 year | No gratuity |

Terminated after 1 but less than 5 years | 21 days of basic pay for each year as gratuity |

Terminated after 5 years | 21 days of basic pay for the first 5 years and 30 days for each year after (Article 132) |

Resignation vs Termination Gratuity Calculation Comparison

In below table, you will find a detailed comparison of UAE gratuity calculation for resignation and termination;

Service Year | Resignation | Termination |

|---|---|---|

Before 1 year | No gratuity | No gratuity |

After 1-3 years | 1/3 of 21 days basic salary for each year | 21 days of basic pay for each year as gratuity |

After 3-5 years | 2/3 of 21 days’ basic salary for each year | 21 days of basic pay for each year as gratuity |

After 5 years | 21 days of basic salary for the first 5 years, 30 days each year after | 21 days of basic pay for the first 5 years and 30 days for each year after |

Difference between Limited and Unlimited Contract

For Resignation: Gratuity is based on a fraction of the basic salary (1/3 or 2/3 of 21 days) for the first few years.

For Termination: Gratuity is calculated fully at 21 days per year (for 1-5 years) and increases after 5 years.

Example Scenario

- Basic Salary: AED 8,000

- Service Years: 6 Years

- Contract Type: Limited

Step 1: Calculate Daily Wage

(8000/30) = 266.66 AED

Step 2: Calculate Gratuity for the First 5 Years

(266.66 x 21) x 5 = 27,999.3 AED

Step 3: Calculate Gratuity for Additional Year

(266.66 x 30) x 1 = 7,999.8 AED

Total Gratuity Amount: 27,999.3+7,999.8=35,999.1 AED

Limited vs Unlimited Contract Gratuity Comparison

Below is the detailed gratuity calculator formula UAE for limited and unlimited contracts.

Contract Type | Service Years | Gratuity Formula | Eligibility |

|---|---|---|---|

Limited Contract | 1 to 5 years | (Basic Salary × 21 days × Service Years) / 30 gratuity | Must complete at least 1 year of service |

Limited Contract | More than 5 years | (Basic Salary × 30 days × Service Years) / 30 | Must have continuous service with no breaks |

Unlimited Contract | 1 to 3 years | 1/3 × (Basic Salary × 21 days × Service Years) / 30 | Applies only after 1 year of service |

Unlimited Contract | 3 to 5 years | 2/3 × (Basic Salary × 21 days × Service Years) / 30 | Eligible if resigned or terminated properly |

Unlimited Contract | More than 5 years | Basic Salary × 30 days × Service Years) ÷ 30 | Full gratuity entitlement for continuous service |

Maximum Limit on Gratuity

As per the new UAE labour law, the total amount of gratuity you can get will never be more than what you would earn in two years of your basic salary. Yes, it is the maximum limit, no matter how many extra years you work. The UAE Labour Law sets this.

Let’s look at an example to make it clear:

Imagine your basic monthly salary is AED 5,000.

Two years of your basic salary would be: AED 5,000 (per month) x 24 months = AED 120,000.

This means that no matter how many years you work in Dubai, your total gratuity payment will never go above AED 120,000. It’s a cap to ensure fairness for both employees and employers. The ESB calculator UAE also implements this when you start calculating your gratuity amount.

Can Gratuity be Denied?

According the Article 139 of UAE Labour Law, an employer can deny to pay gratuity amount in exceptional cases that are;

Employers reserve the right to deny gratuity payment to employees if the employee is found guilty for any one of the above mentioned reasons as per UAE gratuity law requirements.

What Happens When Employers Don’t Pay Gratuity?

As the payment of gratuity is instructed by UAE labour law by MOHRE, If an employer fails to make a gratuity payment, they can face serious consequences as per Article 53 of labour law UAE.

Being an employee in the UAE, you can file a complaint with the Ministry of Human Resources and Emiratisation (MOHRE) if you don’t receive the gratuity amount within 14 days after the end of service employment contract.

Delaying or failing to make the gratuity payment can result in several penalties for the employer, including:

Let’s have a look and explore the UAE gratuity calculation methods for domestic workers.

How to Calculate Final Settlement in UAE?

Full and Final Settlement (FFS) is paid to employee on leaving the job that includes all the payable dues such as overtime calculation in UAE, unused annual leaves, end of service gratuity, bonuses, notice pay (if applicable), unpaid salary, and deductions (loans, advances, installments, etc.) as per labour law Article 53.

In order to calculate the estimated final settlement calculation, you can use the UAE salary check calculator for instant results.

UAE Settlement Calculator

Final Settlement = (Unpaid Salary + Leave Encashment + Gratuity + Other Allowances) – Deductions

Gratuity for Domestic Workers in UAE

The gratuity calculation formula for domestic workers in the UAE, such as housemaids, is different as per the UAE Labour Law. For domestic workers in the UAE, gratuity is calculated as one month’s salary (last basic salary) multiplied by the number of service years. You can use the gratuity calculator UAE for domestic workers to calculate the end-of-service benefit. If you want to calculate the exact amount of the gratuity of any domestic worker in the UAE, you can use the online gratuity calculator for domestic workers for precise results.

Eligibility

Let’s have a look and explore the UAE gratuity calculation methods for domestic workers.

Gratuity vs Tip Concept

Well, many employees get confused when they hear “tip” while working in the UAE as they mix both the terms, gratuity and tip. Let’s break down gratuity vs tip and explore tip calculator and how these terms differ from each other;

Gratuity | Tip |

|---|---|

Gratuity is a legal entitlement for employees for their long-term services as per the UAE Labour Law. It is a mandatory payment when an employee leaves the company after completing one year of service. | A tip is an appreciation payment a customer gives to an employee for their services. It’s not the requirement of any labour law. |

The gratuity amount is calculated on the UAE basic salary multiplied by the number of service years of an employee. | Tips are given at the discretion of the customer, and the amount can vary greatly depending on the quality of service and the customer’s choice. |

The employer is bound to pay the gratuity amount directly to the employee at the time of leaving the company. | The customer pays the tip, and the employer typically does not get involved in the process. |

9 Expert Tips to Maximize Your Gratuity

Here are some tips that can help you save more on your gratuity amount;

Awareness of UAE Labor Law

An employee needs to understand the UAE labour law while working in the UAE, Dubai, or Sharjah. Being familiar with the UAE labour law will definitely make an impact while calculating the daily wages, basic salary, terms of leaving the job, quitting any contract, and most importantly, UAE gratuity calculation methods and their rules.

Staying updated with the latest UAE gratuity calculator MOHRE guidelines will ensure employees are not unpaid and misinformed about their legal job benefit rights.

Review Your Employment Contract

Your employment contract acts as a script of your job and tells everything, such as basic salary, contract duration, company policies, contract type, whether it is limited or unlimited, job role, future promotions (if any), etc. Each job in the UAE has its own rules for end-of-service benefit calculations.

Having a clear picture of your contract in your mind will help you track your benefits and calculations upon leaving the job. Align the employment contract with the latest UAE labour law guidelines to avoid discrepancies and conflict.

Keep Detailed Work Records

Always maintain a proper file and make a habit of keeping a record of UAE labour card, work permit, every written letter, memo, salary slip, offer letter, contract renewal, appointment letter, joining report, JD, or email that presents your employment. Having employment records handy can save more time on the formula for calculating gratuity amounts and help in legal matters.

Complete the Notice Period

If your exit is good, no employer can deny your benefits of gratuity as per UAE labour law. Always serve the proper notice period of 30 days after resigning, and make sure to perform your duty in the notice period just like you do in your regular working days!

Calculate Your Gratuity

Use the indemnity calculator or gratuity calculator UAE available on our website to have a clear picture of your gratuity calculations while leaving the job. Aligning your calculated amount with your FFS makes you satisfied and free from financial stress.

Get Clearance from Employer

You should get clearance from your employer on a specific clearance form that will help you clear all the pending amounts you owe, such as loans, advances, etc. Having clearance while leaving the job will make you stress-free in the UAE. After giving clearance, the employer cannot deduct any additional amount from the gratuity percentage in the salary.

Discuss Concerns with your Employer

If you find any difference with your UAE end-of-service calculator, including gratuity and PF, always talk professionally with your employer. Make a habit of taking notes in writing to get everything done in a job. Discuss your concerns, as it will help you make things smoother and enhance mutual understanding with the employer.

Follow Up Politely

Make sure to follow up politely with your employer about your gratuity concerns. If you don’t get any reply from your employer, you can escalate your case to the Ministry of Human Resources and Emiratisation (MOHRE) or the Ministry of Labour UAE (MOL UAE).

Seek Legal Assistance

If you don’t know how to put your case legally, hire a UAE labour law expert who will help you protect your benefits in the UAE and guide you further.

4 Common Mistakes to Avoid

You will not get accurate results while using the MOHRE gratuity calculator UAE online if you make the following mistakes;

Misinterpreting Basic Salary

One of the most common mistakes is when you mix up your net salary with your basic salary and don’t actually know how to calculate gratuity in the UAE. Always remember, gratuity is calculated in the UAE only on basic salary, excluding all other allowances. Using another amount rather than the basic salary will lead to mistakes and misunderstandings.

Incorrect Service Duration

One of the most impactful factors in calculating the gratuity in the UAE is the period (service year) you have worked for an employer. Therefore, you have to enter the correct date of joining and last working day in the gratuity calculator Abu Dhabi to get 100% accurate results. Remember, for gratuity, you need to complete at least one year of service, as the gratuity calculator in months doesn’t work.

Not Knowing Contract Type

If you are not aware of your contract type, either a limited or unlimited contract, you won’t be able to get the gratuity calculation formula accurately. Entering the incorrect details in the eos calculator will make you shocked at the time when you receive your FFS from your employer.

Misunderstanding Gratuity Rights

The formula of gratuity calculator UAE depends on multiple factors such as last drawn basic salary, contract type, number of service years, and reason for leaving (resigned or terminated), and each factor has its importance. If you misunderstand one of these factors, you will not be able to get the correct UAE formula to calculate gratuity and you will end up with stress and frustration.

Final Words

Gratuity Calculator UAE is designed to facilitate UAE based employees who want to calculate their gratuity digitally within seconds, as it is their right to know how much gratuity they will get while leaving the company. Now you must answer those who ask what is gratuity in salary. Gratuity is an essential part of the end-of-service calculator Dubai.

Whether you are in Dubai, Sharjah, or Abu Dhabi, you must be aware of the UAE labour law guidelines and your employment contract must be aligned with the labour law to get accurate results from both salary check UAE and gratuity calculator UAE. Making a habit of keeping your employment records handy will help you to get your legal rights and staying updated with the MOHRE guidelines will help you get the most out of your gratuity amount and end of service benefits.